The banking industry is experiencing one of the biggest technological shifts in its history—one driven by artificial intelligence (AI). With increasing customer expectations, rising competition from fintech companies, and growing security threats, traditional banking methods are no longer enough. AI has emerged as a powerful tool to enhance efficiency, improve accuracy, reduce operational costs, and deliver highly personalized customer experiences.

From fraud detection to smart chatbots to risk management, AI in banking systems is transforming the future of financial services and redefining how banks operate. Let’s explore how AI is revolutionizing banking and what the future of AI-powered finance looks like.

AI-Driven Customer Service and Personalization

Modern customers expect fast, convenient, and personalized banking services. AI enables banks to deliver exactly that.

AI-powered chatbots and virtual assistants provide 24/7 support, answer queries instantly, and assist with tasks such as account information, payment processing, loan information, and card management. Banks like Bank of America, JPMorgan Chase, and HBL have implemented AI chatbots, making customer service faster and more efficient.

AI also analyzes customer behavior and transaction history to offer personalized financial recommendations, spending insights, and investment suggestions. This level of customization helps banks build stronger customer relationships and enhance loyalty.

Fraud Detection and Security Enhancement

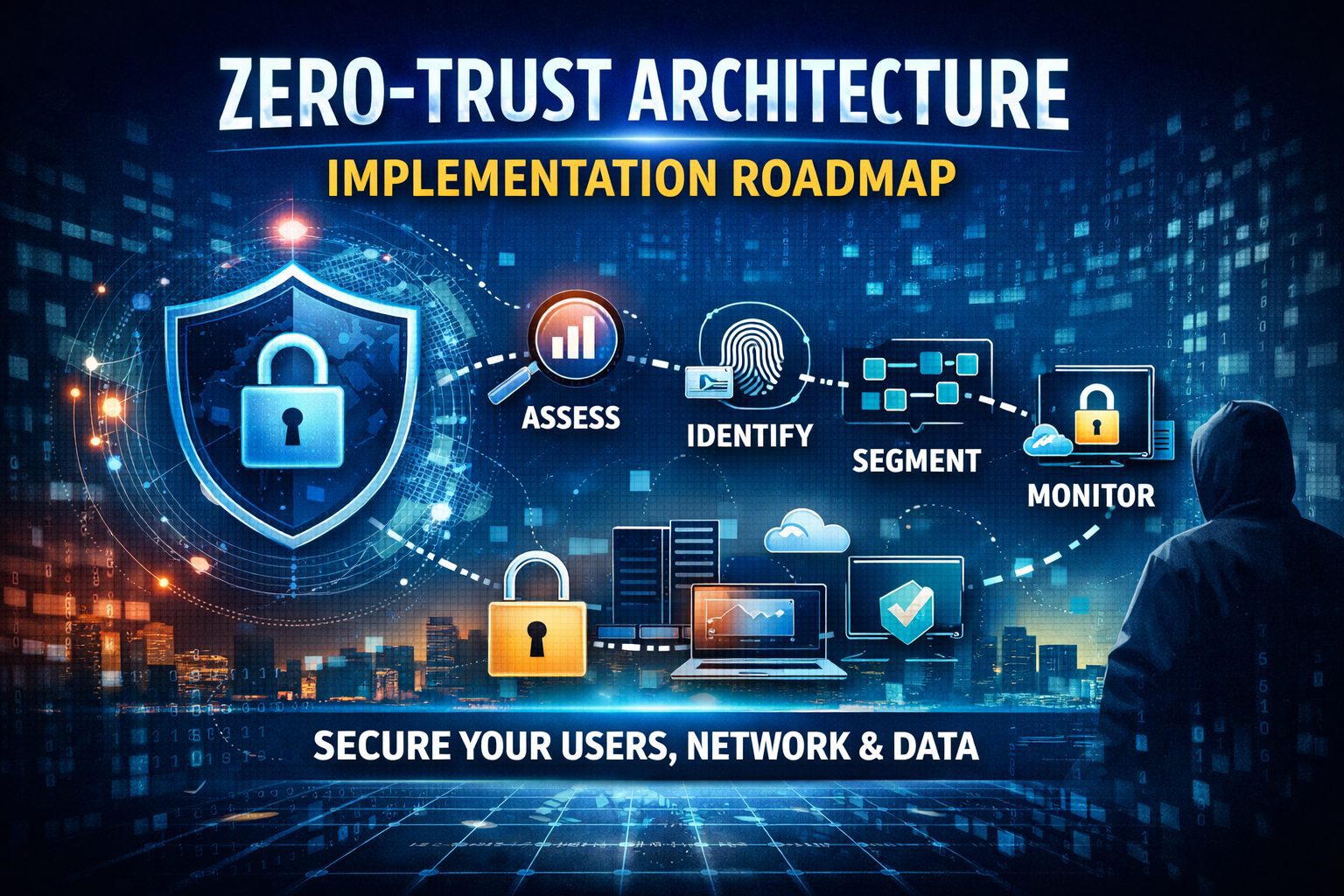

Security is one of the biggest challenges in modern banking. As digital transactions increase, so do cyber threats and fraud attempts. AI plays a crucial role in strengthening fraud detection systems.

Traditional security models rely on predefined rules, but AI-powered systems analyze large volumes of data in real time, detecting abnormal patterns and suspicious behavior instantly. Machine learning models can monitor millions of transactions at once, identify fraud risks, and alert security teams before a breach occurs.

Whether it’s credit card fraud, identity theft, or unusual transaction activity, AI provides a proactive layer of protection—making banking safer for customers and institutions.

Automation of Routine Processes

AI-powered automation, also known as Robotic Process Automation (RPA), is transforming the way banks operate internally. Manual banking tasks like form processing, KYC verification, document management, and compliance checks are time-consuming and prone to errors.

RPA helps automate these repetitive tasks, reducing human effort and improving accuracy. Banks save time, cut operational costs, and speed up services like onboarding, loan approvals, and customer verification.

This automation allows banking staff to focus on high-value tasks such as relationship management, business development, and strategic planning.

Credit Scoring and Loan Processing

Traditional credit assessment relies heavily on historical financial data and manual reviews. AI enhances the credit evaluation process by incorporating additional factors like spending patterns, social behavior, and real-time transaction analysis.

AI-driven credit scoring models can:

- Assess risk more accurately

- Reduce default rates

- Approve eligible loan applicants faster

- Expand lending opportunities for underserved customers

With AI, banks can make faster and fairer lending decisions, minimizing financial risk while increasing financial inclusion.

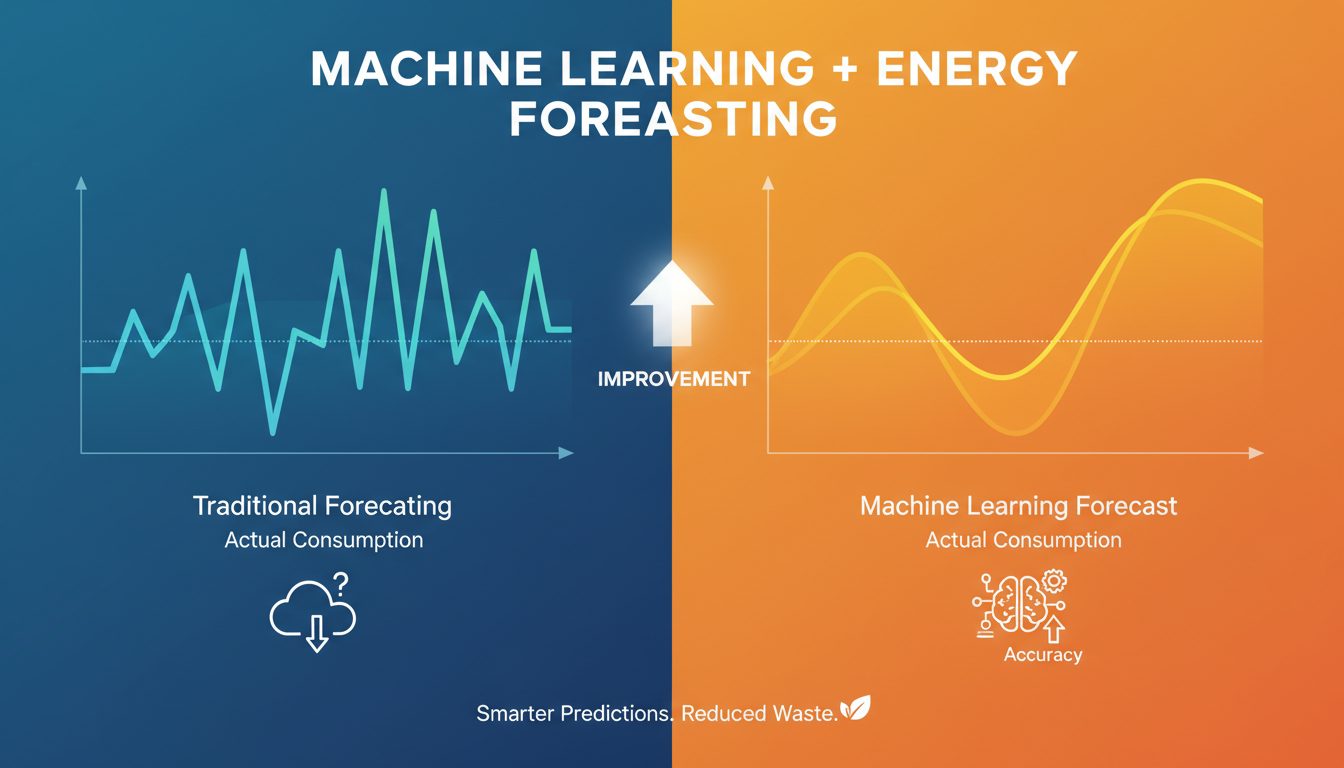

Predictive Analytics for Better Decision-Making

Predictive analytics allows banks to forecast future trends and customer behavior. AI helps financial institutions analyze market conditions, credit risks, customer churn, loan repayment patterns, and investment opportunities.

This helps banks:

- Optimize financial planning

- Improve product development

- Manage liquidity and investment portfolios

- Design better marketing and sales strategies

With data-driven insights, decision-making becomes smarter, more accurate, and future-ready.

Better Regulatory Compliance

Banking regulations are becoming stricter, and compliance failure can result in hefty fines. AI systems help banks stay compliant by monitoring transactions, verifying identities, and tracking activities against regulatory guidelines.

AI also streamlines reporting and audit processes by automatically gathering and analyzing compliance-related data, ensuring transparency and consistency.

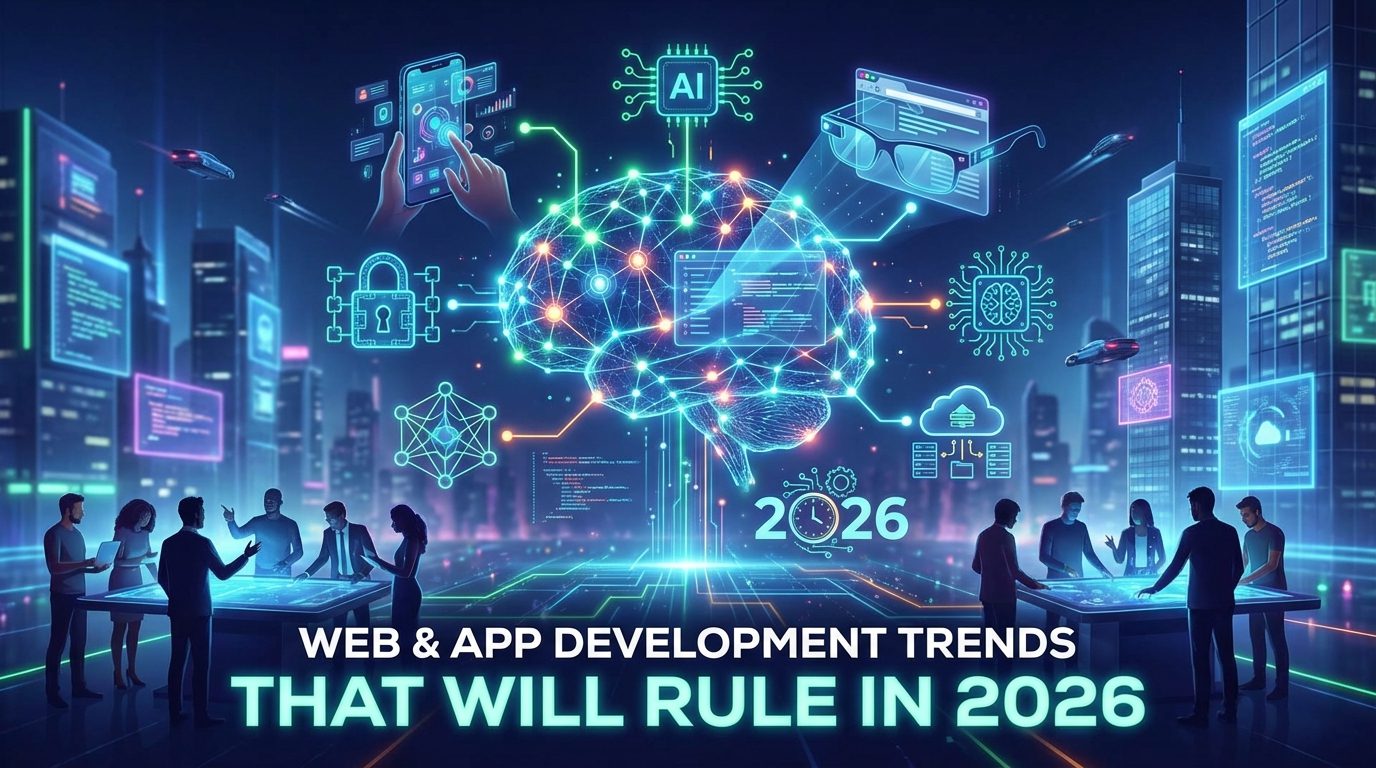

Future of AI in Banking

The future of AI in banking looks promising. As technology evolves, banks will increasingly use AI for:

- Voice-enabled banking

- Blockchain-AI integrations

- Autonomous financial advisory

- Fully automated branches

- Biometric authentication

- Real-time global payment systems

Financial institutions that invest in AI will gain a competitive edge, reduce risk, improve customer satisfaction, and grow faster than traditional banks.

Final Thoughts

AI is no longer optional in the banking world—it is a necessity. It is reshaping the industry by improving security, customer experience, efficiency, and profitability. Banks that embrace AI-powered systems will not only strengthen their operations but also build trust and deliver exceptional value to customers.

As AI continues to evolve, the future of banking will become even more intelligent, personalized, and secure. The transformation has begun—and the banking industry is only at the beginning of a revolutionary digital journey.